Negotiating your way through a divorce or relationship breakdown is difficult as you deal with the emotional issues as well as the practicalities of money, the financial settlement and understanding what your future might look like.

At Retirement Planning Partners, we believe that professional financial advice can make a difference during this challenging time. Our aim is to equip you with the information you need to understand the options available – ensuring you make good decisions today with the confidence you are prepared for tomorrow.

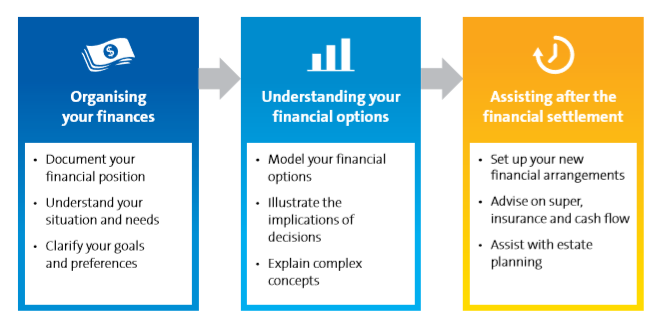

Retirement Planning Partners is a leading financial advice company with a 3 step process to make the financial settlement easier.

Step 1 – Organising your finances

One of the first steps in the financial settlement process is putting all your financial information together into one statement. This financial statement will form the basis of your negotiations and eventually the financial agreement. For many it might be a straightforward listing of the value of your home, mortgage, bank accounts, credit cards and superannuation funds. For others, it is much more complicated – and it’s critical to get this right.

In most relationships, the finances are left to one partner, so it’s not unusual for this to be the first time in some years you’ve had to piece the information together or consider what it takes to meet day-to-day living expenses. Once you are organised and understand your current financial situation, you will want to know your options looking forward.

Step 2 – Understanding your financial options

Understanding your options can give you comfort and a sense of control.

What you need to know

Some questions that you may need help to answer include:

• How should the settlement be structured?

• Which assets work better for me?

• What sort of housing can I afford?

• Where will my income come from?

We can use our knowledge and experience to show you your options. RPP’s financial advisers model a range of possible scenarios to show you what your short and long term financial position might look like given certain decisions. For example, should you keep the house? How long will you need to work before you can retire?

Your solicitor is best placed to advise you on the likely percentage split of assets and any child or spousal support. RPP’s financial modelling will give you a solid foundation and help you make informed decisions. It’s a visually simple, smart reality check to have early in the process.

Step 3. Settlement advice and recommendations

Once a financial agreement has been reached, it’s time to take control of your financial future. Professional financial planning advice can help you align your money, super and assets to your personal financial goals. Our advice is always contained in a Statement of Advice. This is a formal document which details your financial adviser’s recommendations on your financial strategy, right down to the specific funds you should consider.

Decision time

Some of the specific questions you’ll face are:

• Which bank accounts should I keep?

• Which super fund should I use?

• Which assets should I buy or sell and when?

• What insurances do I need?

• Who do I want to benefit when I die?

• How should my estate be structured?

We make recommendations, but the final decisions rest with you.